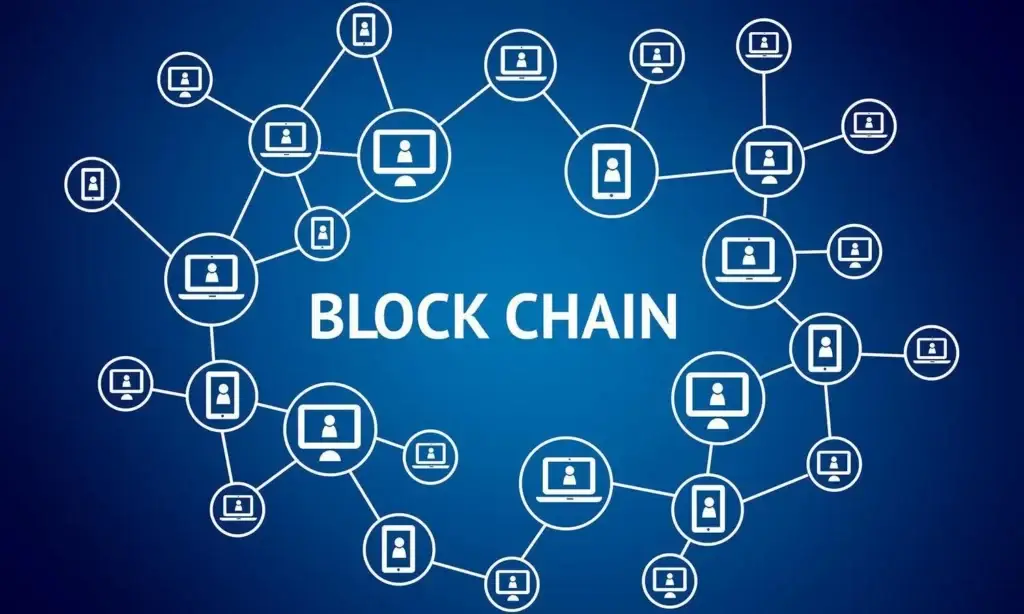

The fundamental innovation changing the approach to data protection and information management is a distributed system: information is written in blocks and stored simultaneously on different network nodes. This structure makes them virtually invulnerable to hackers and eliminates the possibility of information manipulation. Today, blockchain technology is already being used in various sectors, from finance to medicine, demonstrating its importance and providing a new level of security.

What is blockchain technology, and how does it work?

A system for storing and transmitting data that breaks with conventional ideas of protecting information. Unlike centralised systems, where data is stored on a single server, blockchain is decentralised, making it resistant to hacking and data loss. But how does it work?

Let us imagine that data is a chain of blocks, each containing certain information. Each block is linked to the previous one with unique cryptographic keys, and it is impossible to change one without modifying the whole chain. This is the main feature of blockchain technology: the immutability of the data. All information is stored in a distributed register, which allows decentralised management and transfer of data between network participants without risk of manipulation or hacking.

The key elements are

- Decentralised database – information is not stored on a single server, but on multiple nodes in the network.

- Cryptographic protection: Each block is encrypted and linked to the previous one, making the system virtually invulnerable.

- Consensus mechanism: Any change to the data can only be made with the consent of the majority of network participants.

How blockchain technology protects data

One of the main advantages is maximum security. Traditional systems, such as banking databases, are vulnerable to hacking because data is stored centrally. This is not the case with blockchain architecture: the distributed ledger makes hacking virtually impossible, as data is stored on multiple nodes at the same time.

Moreover, each block in a blockchain is cryptographically protected. This means that all information in the blocks is encrypted, and even if an attacker tries to modify the data, it will be impossible without access to most nodes in the network.

What does reliability consist of? It is this:

- Immutability of data – information is stored forever and cannot be tampered with.

- Decentralisation – there is no single point of failure to resist attacks.

Applications of blockchain technology: from cryptocurrencies to medicine.

The possibilities have long since moved beyond the world of digital assets. Today, blockchain technology is being used in sectors ranging from finance to healthcare and logistics. Let’s take a look at how this innovation is being applied in the real economy.

The possibilities have long since moved beyond the world of digital assets. Today, blockchain technology is being used in sectors ranging from finance to healthcare and logistics. Let’s take a look at how this innovation is being applied in the real economy.

Blockchain in banking

The financial sector was one of the first to actively adopt this approach. Organisations have been able to speed up transaction processing and significantly improve the security of financial transactions. Previously, transfers between banks took several days and went through numerous intermediaries. Now, transactions happen almost instantly and the risk of fraud is minimised.

Blockchain technology in medicine

One of the most promising applications. Patients’ electronic medical records can be stored on blockchain, making them immutable and protected. Any doctor or patient can access the data from anywhere in the world, while the data cannot be changed or deleted.

Blockchain in logistics

Companies can now track goods at all stages of delivery. The system allows every transaction to be recorded, from the moment of production to delivery to the final consumer. This ensures transparency, prevents counterfeiting and guarantees supply chain reliability.

Smart contracts: the future of business

One of the most innovative solutions offered by blockchain technology is smart contracts. These are special programmes that automatically execute the terms of a transaction written in code. Unlike traditional contracts, smart versions exclude the involvement of intermediaries and work without human intervention.

Advantages:

- Automation – transactions are executed without human intervention, reducing costs and eliminating errors.

- Transparency – all transaction terms are visible to both parties and detailed in code.

- Security – data is encrypted and protected against hacking.

Blockchain for business and its smart contracts are radically changing the rules of the game. In the real estate sector, for example, a smart contract can automatically transfer ownership after all the terms of the agreement are met.

Blockchain technology in Russia: prospects and challenges

This area is actively developing domestically and its potential is visible in both the private and public sectors. Government institutions and large companies have already started applying blockchain technology to improve the transparency and security of their processes.

Examples include:

- State registries – to record property rights, ensure transparency of transactions and data protection.

- Blockchain in banks – to simplify cross-border payments and improve the security of financial transactions.

- Supply chains – the architecture helps trace the origin of goods, which is especially important for industries such as agriculture and energy.

The future with blockchain technology

A true revolution in the world of data – the system offers security, transparency and immutability of information, making it an ideal solution for a wide range of industries. From finance to healthcare, logistics to utilities, blockchain technology is already changing the rules of the game and its potential is only just beginning to be realised.

Conclusion

Blockchain technology has proven its worth in various sectors and continues to evolve to provide solutions to the most complex challenges. It can be used to secure data, automate business processes and create transparent supply chains.

Blockchain technology has proven its worth in various sectors and continues to evolve to provide solutions to the most complex challenges. It can be used to secure data, automate business processes and create transparent supply chains.

en

en  de

de  ar

ar  es

es  nl

nl  hi

hi  fr

fr  it

it  pt

pt  el

el